-

Estimating Bad Debts Financial Accounting

Fluctuating expenses and irregular sales patterns can distort the correlation, impacting the accuracy of profit estimations. In such scenarios, the method’s rigidity fails to reflect the evolving nature of business operations, potentially leading to misinformed decisions based on flawed cost allocation and profit projections. The Allowance for Doubtful Accounts account can have either a debit or credit balance before the year-end adjustment. percentage of sales method example In the percentage of sales method, firms set their sales budget as a specified percentage of current or expected sales. This method is commonly used by firms involved in the mass selling of goods and or those governed by finance. The percentage-of-sales budget method is one of the simplest budget methods available.

- In year 2021, it has completely migrated to the e-commerce business.

- Moreover, setting an advertising budget helps you establish a realistic framework for your marketing activities.

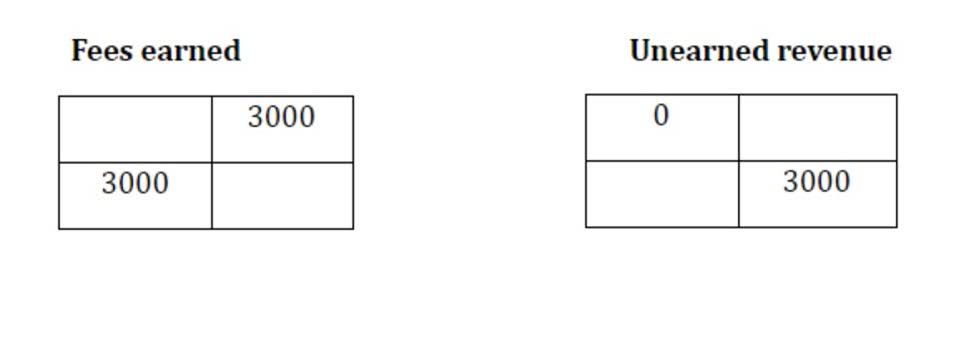

- The allowance method is a technique for estimating and recording of uncollectible amounts when a customer fails to pay, and is the preferred alternative to the direct write-off method.

- If the percentage was 35% last year, management would want to know why making rolls has become more expensive.

- This takes the credit sales method a step further by calculating roughly how much a company can expect not to be paid back from customers if they haven’t paid their credit sales after 90 days.

Types of Sales Budgeting

Using data mined from your CRM — along with more in-depth forecasting methods — can help you make more consistent, accurate forecasts. This method is applied by calculating a certain percentage of sales related to the cost of goods sold. By using this approach, companies can adapt their inventory levels according to fluctuating sales performance, thus preventing overstocking or stockouts. This dynamic adjustment promotes efficient utilization of working capital, cost reduction, and improved service levels. It also contributes to a better match between inventory levels and customer demand, aligning supply and demand more effectively and enhancing overall business performance.

Percentage of sales method: What it is and how to calculate it

So when we do the percentage of sales method, the first thing I want to note is that we’re talking about credit sales here, right? Sometimes they like to trick you, and in a question, they’ll say, you know, the company had 5,000,000 in cash sales and then 10,000,000 in credit sales. When we talk about the allowance, this is only about money that’s owed to us. The cash sales, well, we already received the cash, so it doesn’t really matter in that case. This illustrates that in this example, 25% of your sales revenue is allocated to your cost of goods sold account.

C. Forecasting the Cash Flow Statement

- Say Jim runs a retail running shoe store, and has the following line items he wants to forecast.

- It looks at financial items like the cost of goods sold (COGS) and accounts receivable as a percentage of your total sales.

- In this step, businesses hope to obtain positive percentages in all accounts.

- By looking over her records, she finds that for the month, her credit purchases come to $55,000 (with $5,000 cash).

- Easily calculate drop-off rates and learn how to increase conversion and close rates.

- You need to be aware of the financial line item you wish to analyze and your company’s sales data in order to make a financial prediction using the percentage of sales method.

The percentage-of-sales method is a financial forecasting retained earnings balance sheet model that assesses a company’s financial future by making financial forecasts based on monthly sales revenue and current sales data. This forecasting method uses estimated overarching sales growth to determine changes to any financial line items that directly correlate to sales. This is commonly done by percentage — if you know the percent amount your sales will increase, you can apply that to all line items as well, both assets and expenses. This includes things like accounts payable, accounts receivable, cash, cost of goods sold (COGS), fixed assets, and net income. The cost of goods sold, inventory, and cash are just a few examples of the financial line items that are calculated as a percentage of sales in the percent of sales method of financial forecasting. These percentages are then used to project the future value of each line item using estimates of future sales.

The accounts receivable to sales ratio measures a company’s liquidity by determining how many sales are happening on credit. The business could run into short-term cash flow problems if the ratio is too high. For this reason, it’s an important additional https://www.bookstime.com/ ratio to consider when running a percentage of the sales forecast. To calculate your potential bad debts expense (BDE), simply multiply your total credit sales by the percentage you anticipate losing. Let’s say a company has total sales revenue of $500,000 and total expenses of $300,000. By using the Percentage of Sales Method, we can see that 60% of the company’s expenses are directly related to its sales.

Trial Balance

While each approach to setting an advertising budget has its merits, it is important to recognize their limitations. But even for bigger companies, the percentage-of-sales method may not work as well if they’ve had a big change in operations or structure that’s taken place to drive more sales. Especially when it comes to creating a budgeted set of financial statements. Once she has the specific accounts she wants to keep tabs on, she has to find how they stack up to her overall sales figures. Let’s use the example of a potter named Harry, whose revenue was $100k last year, and he expects sales to increase 50% next year. This number may seem small, but it’s crucial when you remember that she’s hoping for an increase of sales next month of $1,978.

By applying this method, businesses can efficiently plan for financial needs, manage cash flow, and make informed strategic decisions. This article explores the percentage of sales method, its application, benefits, limitations, and best practices. This method involves calculating the estimated bad debt expense by applying a predetermined percentage to the total sales revenue.